Asian tiger Taiwan is now targeting growing digital health exports as part of its next wave of hi-tech growth, Jon Hoeksma reports.

Taiwan, for years synonymous with hi-tech manufacturing of chips and components, is beginning to target hi-tech medical equipment and disruptive digital health start-ups as a key future growth sector.

With a population of 23.5 million, the self-styled Republic of China is an international anomaly regarded by nearby mainland China as a breakaway province and recognised by very few UN members.

Small wonder then that Taiwan has had a relentless focus on exports to grow the economy, and forms one of the fabled Asian tiger economies, with government export agency Taitra leading the export charge.

“Our aim is to change perceptions about the quality and innovation of Taiwanese medical technology exports,” James Huang, chair of Taitra, told a recent media tour Digital Health News took part in.

He said that many Taiwanese technology and mobile companies are now moving into health.

“ICT, IoT (internet of things) and mobile businesses are all now developing health activities. We’re seeing a big movement from networks and PCs to smart medical devices,” he said.

Huang joked that the majority of Taiwanese businesses are SMEs as “everyone wants to be the boss”, adding that SMEs need more help to export.

This in-depth support from Taitra help spans incubators, R&D support, business parks (six for health and life sciences alone), export programmes, trade shows, market access and marketing services.

From garages and into hospitals

Health has been a key target market since the 1970s, beginning with government support for relatively simple medical equipment and device companies, and component manufacturers. A raft of medical device SMEs started in the 1970s, some now into their second or third generation of growth as a family business.

But thanks to a booming economy and pressure from lower-cost manufacturers in China, many Taiwanese medical device companies are now deciding to focus on higher value digital health products and services.

One such example is Spirit Medical Company, previously the world’s largest manufacturer of stethoscopes, but now facing intense competition from China in what has become a commodity market. But as a result it is about to launch a low-cost video otoscope instrument, it’s first digital health medical device.

Another example is Doctors Friend Medical Instrument Company, literally launched out of a garage in 1970 by a technician who used to service hospital pumps and then decided to manufacture his own.

Nearly 50 years on, his grand-daughter, Karen Chang, a young business graduate of Newcastle University with fond memories of the city’s night-life, is helping take the company high-tech with a range that includes innovative materials and a range of cost-effective vacuum pumps.

Selling into a raft of European markets such as Poland, Greece and Italy, Chang says that it can still be tough to sell into markets like US and Germany, which have strong local companies and where Taiwanese firms are not always yet associated with quality.

However, Chang added that the current trade war between the US and China is providing an unexpected boost, as US buyers switch orders they would otherwise have placed with Chinese firms.

The next wave of innovation

Innovation, quality, keen pricing and a global export focus is a mantra for many of Taiwan’s next wave of med-tech firms.

One example is Protectlife International Biomedical, a pioneer of compact spectrum-based multi-analyte detection platform designed to enable quick, easy, and simultaneous monitoring of biomarkers in a micro-sample of blood, for use in clinics and veterinary surgeries.

No bigger than a compact home laser printer. The company grew out of a government incubator for bioinformatics and life science firms.

The Taiwanese government provides a diverse range of support to help companies: from innovation clusters, to loans to support R&D, export services and major events to promote key Taiwanese sectors.

All of the innovations described in this feature were on show at MedicalTaiwan, an annual government trade show focused on promoting med tech exports, which this year included a smart operating theatre showing how a range of devices and monitors connect.

Cutting-edge technology

The Taiwanese healthcare system ranks well in international indices, is highly digitised but has to date eschewed the familiar line-up of big American electronic medical software suppliers, relying instead on locally developed solutions. While there were few clinical software exhibiting at Medical Taiwan, there were cutting-edge hardware companies

Most impressive was Freebionics’ Free Walk robot exoskeleton for spinal injury patients (think Wallace and Gromit: The Wrong Trousers gone high-tech), a smart powered exo-skeleton that can enable patients to walk again.

A test drive is a disconcerting experience but points to a robot-assisted future of medical devices. Developed by Free Bionics Taiwan Inc, the exoskeleton is due to launch at the end of year initially at around 50,000 Euros per unit

Other high-tech start-ups on display build on a strong university sector and close links with US high-tech investors and Californian tech firms.

Brain Age is an artificial intelligence (AI) start-up born out of the National Taiwan University that uses AI to interpret MRI scans and spot structural changes in the brain that can enable much earlier detection of dementia.

By analysing regular MRI scans, Brain Age can provide the patient and his doctor with an accurate brain age score, based on the structure of the brain.

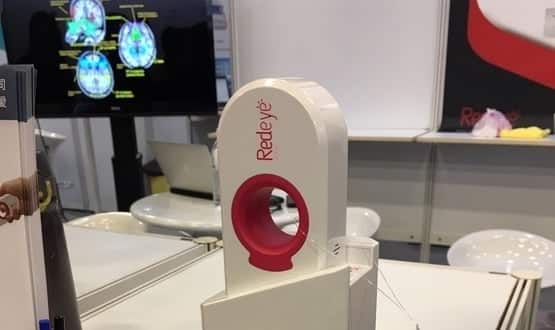

Another disruptive start-up focused on prevention and early detection is Red Spot, a home diagnostic device designed to spot invisible blood in toilet water to aid early detection of prostate cancer. The camera-based device takes a picture of the toilet water and sends the results to a doctor through a wireless base station.

Due to a national love affair with fried pork, Taiwan unfortunately has the highest male adult prostate cancer rate in the world. Small wonder then that Taiwanese men are urged to have test for invisible blood in their toilet water at least once a year, ideally much more regularly.

Taiwan’s hospitals are also proving a hot-bed for digital health and med tech innovations, and were showcasing a range of innovations.

These included a mobile ophthalmology clinic, developed for use in small outlying Taiwanese islands, and a range of apps and digital products.

One of the most eye-catching is a smart nappy Nursemaid app for anxious parents, with sensors to measure a baby’s temperature, perspiration, sleep and movement.

While Taiwan may not be your first thought when talking about digital health, it is clear the country has a lot of offer in terms of innovation.

15 August 2019 @ 19:59

No doubt this translates into Taiwan being an important market for the “treasure trove” of NHS cradle-to-grave patient data. Can we expect a trade delegation to Taiwan from the UK Government, with Mr Hancock on board? Smart nappies just about sums it up. All we need is a version for the dying as well, and why not smart pants to fill the gap? NHS patients can then really “take control of their health”, and at the same time do their bit for the UK economy.